- 6 April 2023

- Posted by: Federica Montella

- Categories: eToro CopyTrader, Investing

Wall Street was mostly down on Wednesday

Only the Dow Jones reported a profit, among the three US major indexes.

The S&P 500 finished at -0.25%, the Nasdaq ended the trading session at -1.07% and the Dow Jones closed at +0.24%.

The negative movement has been driven by the latest negative economic data.

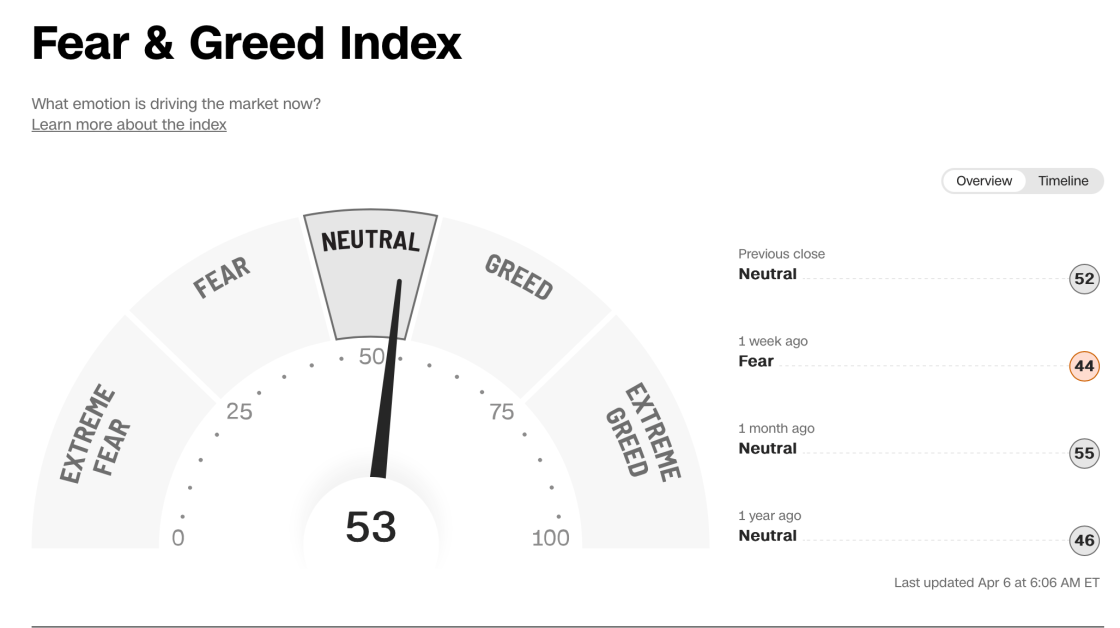

The investors’ sentiment is Neutral, as indicated in the graph below:

Sentiment indicator – Fear & Greed Index

The market sentiment is 53, in “Neutral” mode, different from last’s week data when the sentiment was Fear.

The US economy is slowing down

The latest economic data, released this week are indicating a weak labour market.

The ADP non-farm Employment Report was published, on Wednesday, and it showed an increase of 145,000 units in March.

The data is far less than February’s figure which was 261,000 and below analysts’ expectations which was 200,000.

Another data that confirms the negative trend of the US job market is the Job openings report released on 4 April.

That report has shown 9.931M of opening positions, less than the 10.563M of the previous month and below economist’s forecasts.

It was the biggest job opening decline since February 2021 and this means that the labour market is starting to slow down.

The Federal Reserve’s restrictive monetary policy to fight inflation is having its effects on the unemployment level in the US.

What to watch today

The weekly US initial jobless claims will be released today at 13:30 GMT.

It is forecasted to be at 200,000.

This will be another important data to watch to understand the health of the US labour market.

Financial markets could be volatile.

Portfolio update

I remain neutral and cautious about the stock market.

I hold long and short stock positions and aim to profit regardless of the market direction.

If you are already copying my portfolio, please keep the copy open.

If you are thinking of copying me, now could be the right time, if you can invest for the long term (years).

Remember to copy the open trades to optimize the copy.

Remember to set the stop loss on the copy at the minimum level, so you don’t get stopped if there is a correction.

Thank you, everyone. Have a nice day!

Steps to follow to copy my portfolio automatically:

1. Create an eToro account here: https://federicamontella.com/go/etoro/

2. Verify your account and make a deposit of at least 200 USD (you can deposit in any currency, like GBP and EUR)

3. Go to my profile page: https://federicamontella.com/go/etoro-passionforprofit/

4. Start the copy (copy open trades and set the lowest stop loss possible, to allow some movement)

5. Enjoy, it’s all automatic. You will make passive income 24/7

Let me know if you have any questions.

Federica Montella

eToro Popular Investor